PREPARING YOUR WORKSHOP FOR THE CHALLENGING TIMES AHEAD

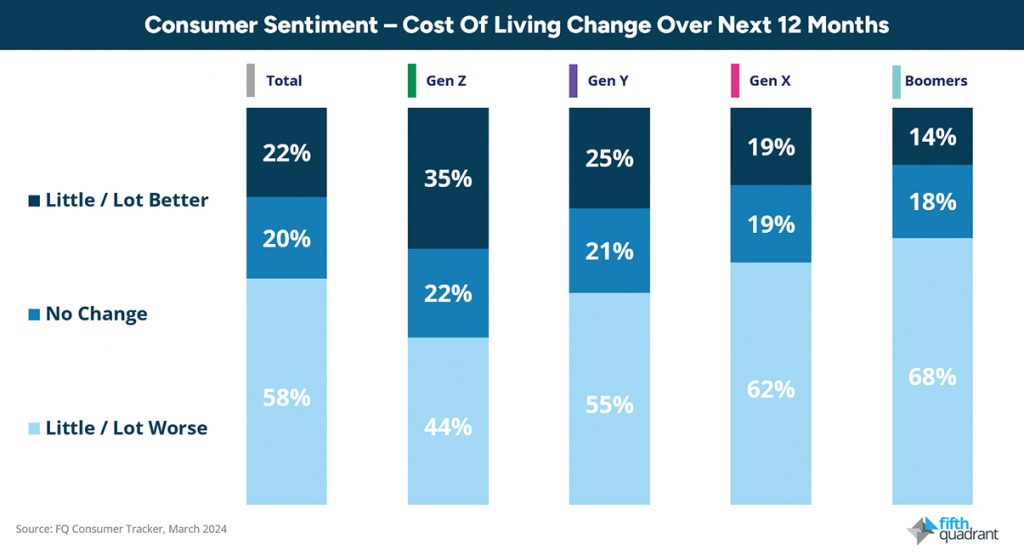

Australian households are looking ahead with cautious eyes according to the latest Fifth Quadrant Consumer Sentiment research, with cost-of-living pressures set to squeeze household budgets even tighter

Negative sentiment is evident across the board, with almost three in five consumers expecting their situation to get worse over the next 12 months.

Importantly, no generation sees a substantial improvement coming, suggesting that households nationwide are bracing for continued economic pressure.

With that said, we can see a level of variation across age groups, with Baby Boomers and Gen X the most pessimistic, Gen Y slightly more positive, and Gen Z showing relative optimism, potentially reflecting the hope and resilience of youth.

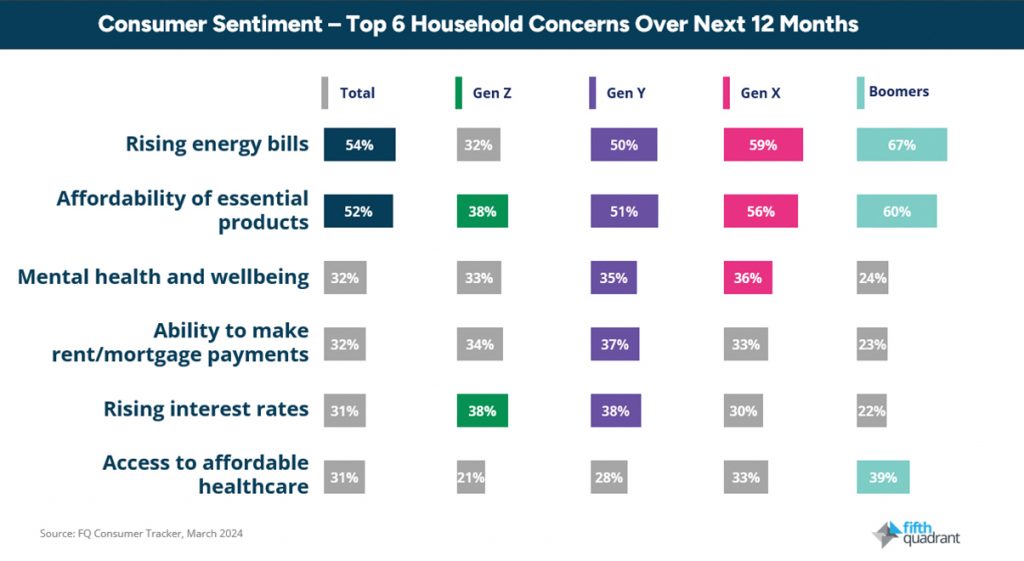

Concerns about utilities and basic essentials

Consumer sentiment is clearly grounded in the significant (and frequently) increasing bills facing households, with rising utility bills the primary concern across all generations.

This is followed by the affordability of essential products, highlighting economic pressure that goes beyond luxuries and treats — this is about the day-to-day ability to provide for your household.

Overall, this data reveals a level of apprehension about financial stability, healthcare accessibility, and the cost of living. It paints a picture of a year where prudent financial management will be key for Australian households.

We also need to recognise the prominence of mental health and wellbeing in the results, emphasising the stress of Australia’s changing work environment and economic uncertainty.

Around one in three Australians in each group (except Baby Boomers) called mental health and wellbeing out as a significant concern, highlighting the need for support amidst the stress of modern work-life and financial pressures.

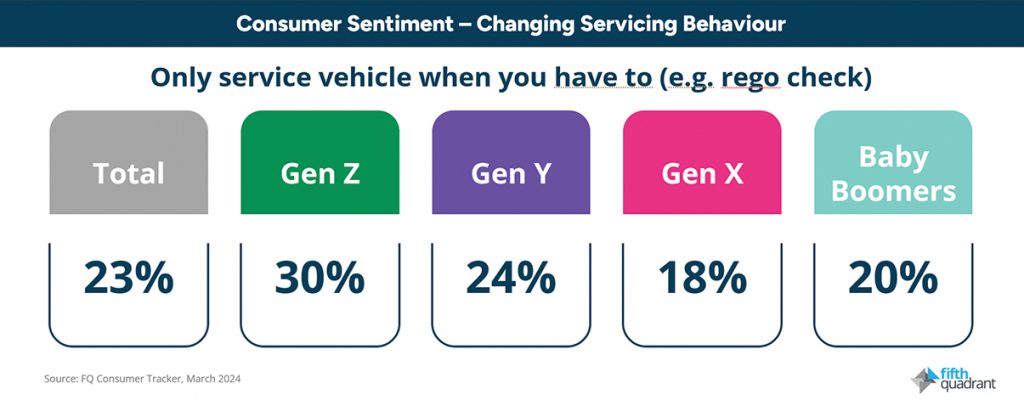

Impact on servicing behaviours

Given the pressure on household spending, it is no surprise that Australians are increasingly selective about car maintenance.

Almost one in four admit to only visiting a workshop for necessities like registration checks.

While Gen Z are the most likely to admit to this behaviour, it is present across the board, with Australians of all ages adopting a ‘service-when-required’ approach, potentially deferring regular maintenance in favour of other financial demands.

Looking ahead

Australian consumers clearly don’t see an end to current cost-of-living pressure, expecting the situation to worsen over the next 12 months.

It is no surprise that this would carry over into their vehicle servicing behaviours, but this is a significant red flag for automotive workshops.

Even though businesses might not yet be seeing reduced volumes, it is important to start looking at options that can help keep work ticking over in the months ahead.

Looking at strategies that commonly emerge in our research, this could include more structured proactive service reminders to customers (via email, SMS, or phone call), emphasising the potential risk and additional cost of delayed maintenance versus regular check-ups.

Similarly, workshops can more explicitly discuss the different servicing packages they offer that can cater to tightened budgets, promoting budget-friendly options that may help to maintain a steadier customer flow.

Each workshop is unique, and business owners are best placed to decide how to process. Regardless of the strategy taken though, workshops that can demonstrate they understand and are adjusting to their customers’ financial realities will likely fare better, maintaining relevance and building stronger relationships for the future.

This column was prepared for AAA Magazine by Fifth Quadrant, the AAAA’s partners in the AAAA Aftermarket Dashboard which is delivered to AAAA members each quarter.

For more information about Fifth Quadrant’s services, visit www.fifthquadrant.com.au or contact Ben Selwyn on ben@fifthquadrant.com.au