SHIFTING GEARS: UNVEILING THE HIDDEN DYNAMICS OF AUSTRALIA’S USED CAR MARKET

When it comes to vehicle sales trends, we’ve historically focused on the new car market due to readily available and reliable sales updates, explains Fifth Quadrant

While the used car market is arguably more relevant to the aftermarket, it has had to take a backseat due to the absence of dependable data.

Used car sales data is now however becoming more increasingly available, and we can dig into this to uncover trends around sales volumes, fuel types, and vehicle types.

This is important for automotive workshops as change of ownership is a key trigger for vehicles shifting into aftermarket servicing.

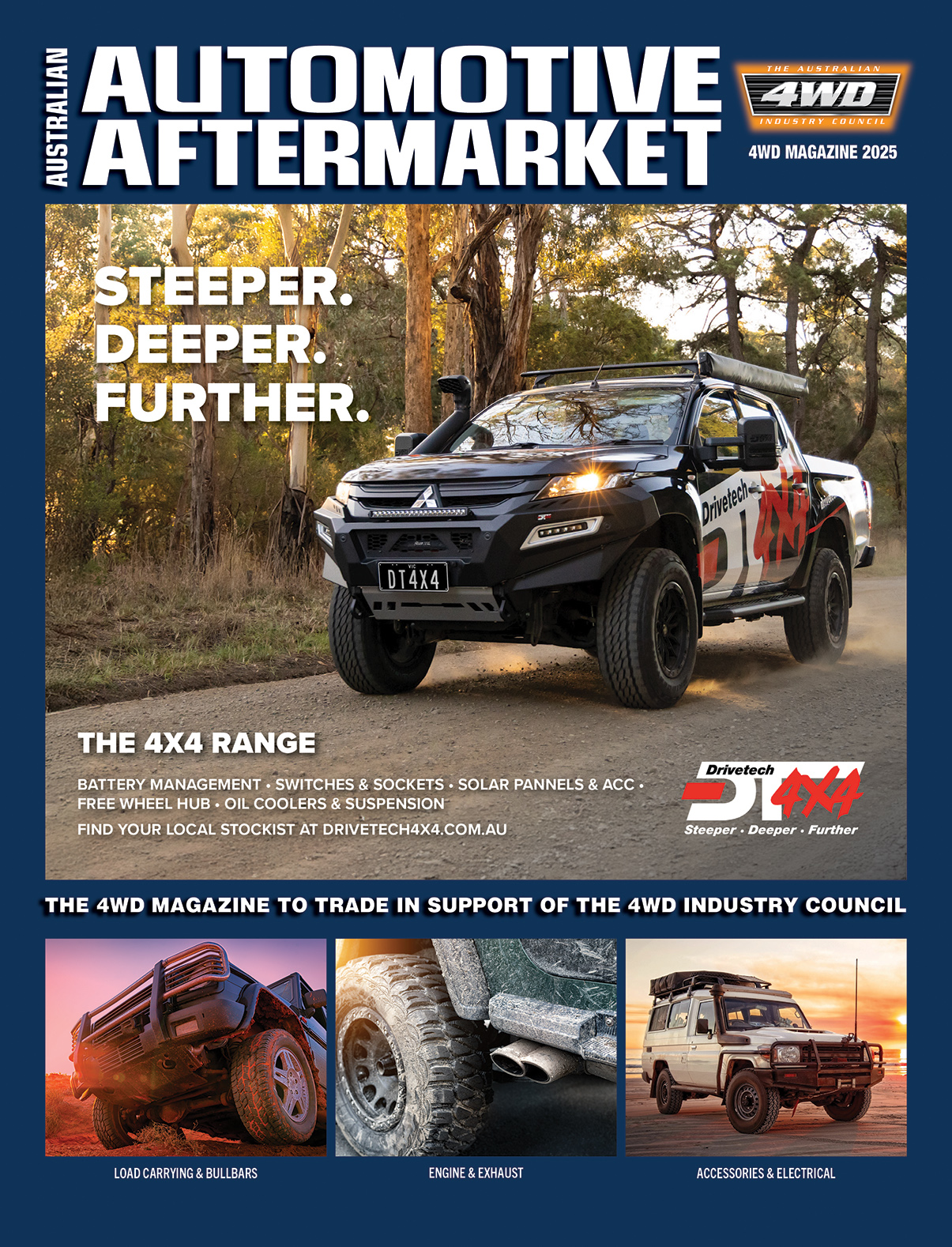

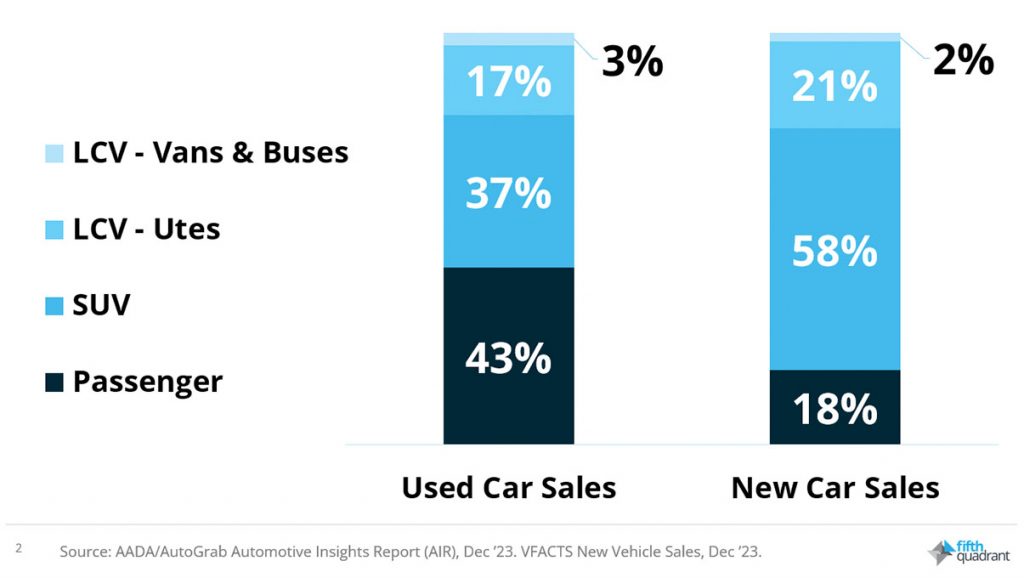

Through 2023, 2,074,535 used vehicles were sold (inclusive of passenger vehicles, SUVs, Utes, Vans and Buses), almost double the new sales of 1,165,008 vehicles (excluding heavy commercial).

This highlights the sheer volume of vehicle circulation outside of dealerships, with most of these transactions happening on a person-to-person basis.

It is also important to note how many more passenger vehicles are being bought second hand.

Despite SUVs owning more than half of the total new vehicle market, passenger vehicles still outnumber them when it comes to second-hand sales. There is clearly still a role for passenger vehicles, as a first car for new drivers, a reasonably priced second car for households, and so on.

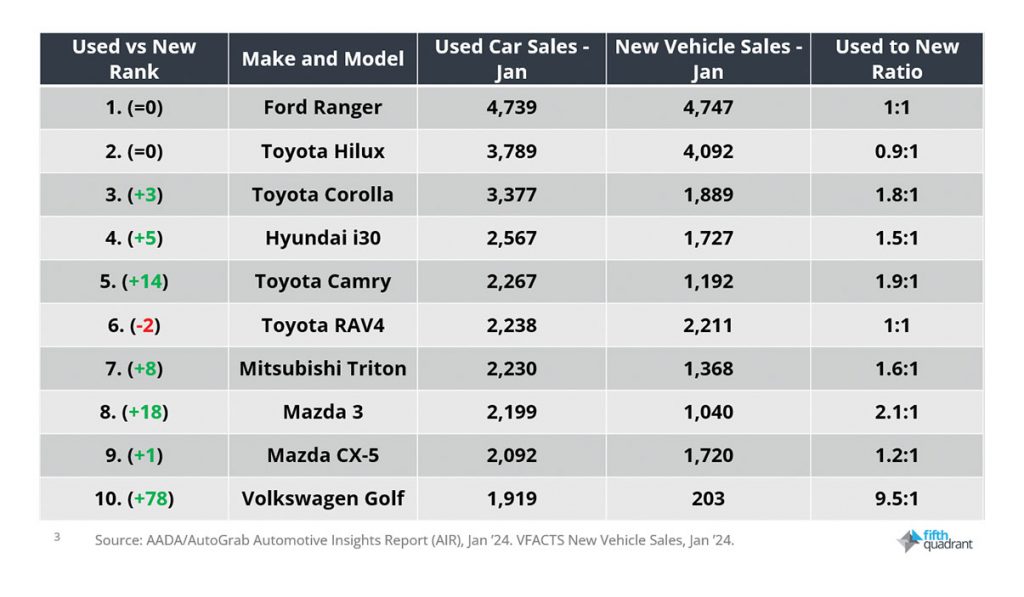

If we compare new and used vehicle sales data for the month of January, two familiar faces emerge, with the Ford Ranger and Toyota Hilux securing the first and second spots in both sets of sales charts, underscoring their longevity and popularity in the Australian market.

Following closely behind though, we begin to see the popularity of passenger cars (and in many cases those with strong hybrid options), with the Toyota Corolla, Hyundai i30, Toyota Camry, and Mazda 3 all proving popular in the used car market.

A notable entrant at 10th on the list is the Volkswagen Golf, which saw a remarkable 9.5 used sales to every ne new one for the month of January.

This highlights the importance of paying attention to used vehicle data, as popular models like the Golf continue to circulate widely despite weaker performance in the new market.

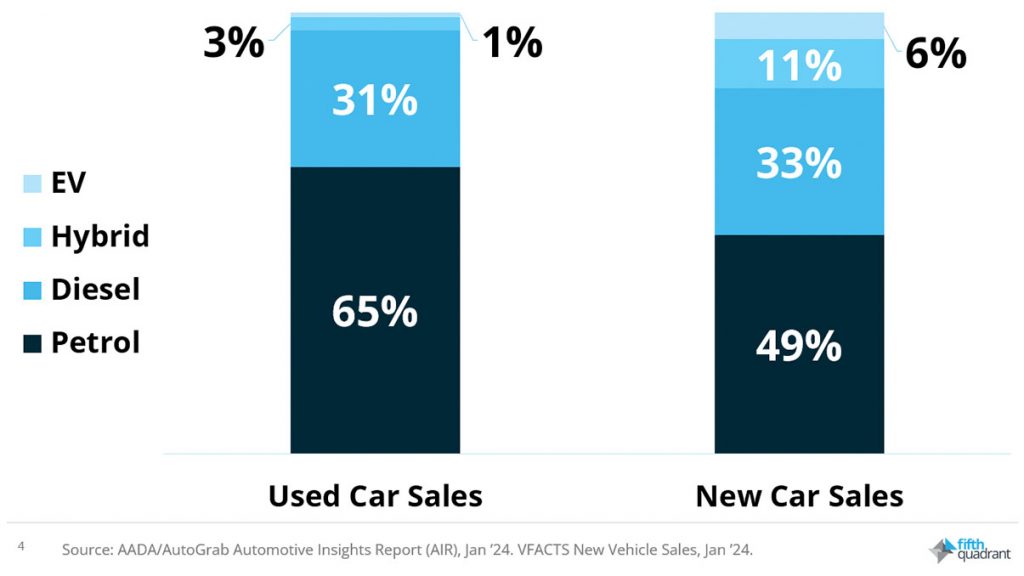

Shifting focus to fuel types reveals another notable contrast to new vehicles. Despite calling out the Corolla and Camry as models with a strong hybrid offering, just four precent of used vehicle sales in January were EVs or Hybrids (with almost two thirds running on petrol).

In contrast, around one in six new vehicles last month were ZLEVs, with petrol and diesel accounting for 82 percent of sales.

This underscores that whilst there is understandably a level of focus on the entrance of Hybrids and EVs into the Australian car parc, automotive workshops around Australia are likely to benefit from maintaining a greater focus on petrol and diesel operated vehicles for a while yet.

To summarise, as workshop operators strive to meet the ongoing demand for parts and services, understanding the preferences of consumers in the used car market becomes increasingly crucial.

Moreover, the data underscores the continued importance of traditional petrol and diesel vehicles, even amidst the growing interest in hybrid and electric alternatives.

By staying attuned to these trends, aftermarket workshops can better adapt and thrive in the ever-evolving landscape of the Australian automotive aftermarket.

This column was prepared for AAAA Magazine by Fifth Quadrant, the AAAA’s partners in the AAAA Aftermarket Dashboard which is delivered to AAAA members each quarter.

For more information about their services, visit www.fifthquadrant.com.au or contact Ben Selwyn on ben@fifthquadrant.com.au