WAS/NOW PRICE COMPARISONS

Displaying was/now price comparisons when discounting products, including services, are a great way to promote your business

However, it is important to remember that if was/now price comparisons do not comply with the Australian Consumer Law (ACL) penalties may be imposed.

What is a was/now price comparison?

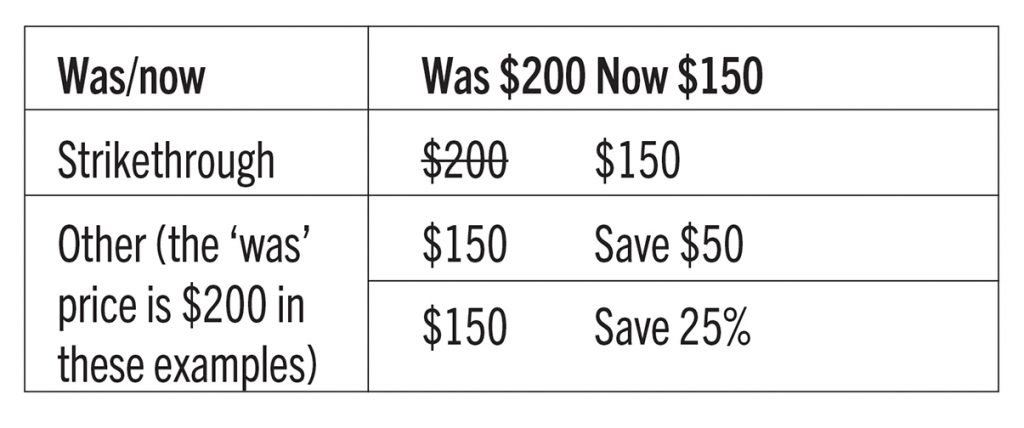

A was/now price comparison compares the ‘was’ price of a product with a discounted ‘now’ price to show consumers the saving they will achieve by purchasing the product at the discounted price. The was/now price comparison can take several forms for example:

How can was/now price comparisons contravene the ACL?

False or misleading was/now price comparisons will contravene the ACL. A was/now price comparison will likely comply with the ACL if it can be proven that the saving to the consumer claimed by the business is achieved (for example, using the above example, the saving claim is $50).

In deciding if the saving claim is achieved the central query is if the ‘was’ price is the price a consumer would have paid for the product for a reasonable amount of time before the ‘now’ price sale. If so, it is likely the was/now price comparison is ACL compliant. However, other factors may impact on whether a business can prove the saving claim was achieved. For example:

• if the business engages in the practice of regular discounting (so that products are sold below the ticketed price); and/or

• if the product was rarely or never sold at the ‘was’ price before the ‘now’ price sale.

In these circumstances it may be difficult for the business to prove the ‘was’ price is the price the consumer would have paid for the product for a reasonable amount of time before the ‘now’ price sale by using sales records. This means there would be a risk to the business in making the was/now price comparison representations, because the business would need to rely on evidence other than sales records to prove the saving claim.

What is a reasonable amount of time the product should have been sold at the ‘was’ price?

This will vary depending on the market, product type and how often the price is changed for the product or price changes occur within the market. As an example, the Federal Court in ACCC v Jewellery Group Pty Ltd [2012] FCA 848 found that four months was a reasonable period of time within which to prove a product had been sold at the ‘was’ price in a jewellery store that had several sales per year. As noted, this may vary depending on the product and/or the market.

Discount prices only for a limited amount of time

It is also important to ensure that products are discounted for a limited period of time. This is because if a product is priced at a discounted sale price longer than a reasonable amount of time, then the discounted sale price essentially becomes the selling price of the product. Meaning that the product can no longer be considered on sale and the original pre-discount price could only be used in a was/now price comparison if the product is sold at the original pre-discount price for a reasonable amount of time.

Compliance guidance

Following the below guidelines may assist the business to comply with the ACL when engaging in was/now price comparisons.

- Do not create false ‘was’ prices. For example, if a product is priced at $200 before a sale the ACL will be contravened if the business gives any of the following price comparisons:

a. Was $250 Now $200, $250 $200, $200 Save $50 or $200 Save 20 percent.

b. Was $300 Now $250, $300 $250, $250 Save $50 or $250 Save 16.7 percent. - Ensure that the product is offered to consumers at the ‘was’ price for a reasonable amount of time before the ‘now’ price comparison is represented to consumers.

- Do not discount prices for more than a reasonable amount of time as the discounted price may become the actual price of the product.

- If the product is displayed at a discounted price before being discounted again the business should not use was/now pricing directly comparing the original ticket price with the further discounted price (use wording such as ‘a further 20 percent/$X off’ instead).

- If engaging in was/now price comparisons check sales records to see if the business is in a position to prove the saving claim by showing the product was sold at the ‘was’ price for a reasonable amount of time before the sale (keep the information in a file).

Non-Compliance

If was/now advertising is not compliant with the ACL, the following may apply:

• the ACCC may issue an infringement notice, carrying a financial penalty of 60 penalty units for a body corporate (currently totaling $12,600), and 12 penalty units for an individual (currently totaling $2,520);

• the court may impose a maximum criminal or civil penalty for a body corporate of up to the greater of $10 million, three times the value gained or if this can’t be determined, then 10 percent of the annual turnover of the body corporate in the 12 month period before the act, or for an individual up to $500,000; and

• Non-punitive orders may also be made, such as corrective advertising and the establishment of a compliance program.

Takeaways

The key takeaways are:

• ensure a product is sold at the ‘was’ price for a reasonable period before making a was/now price comparison representation;

• if a product has a discounted price for more than a limited time that price effectively becomes the actual price of the product; and

• take steps to ensure that your business is in a position to prove was/now price comparison saving claim is achieved.

Liability limited by a scheme approved under professional standards legislation.

This document is intended for general information purposes only and should not be regarded as legal advice. Please contact Industry Legal if you require legal advice.

AAAA Member Benefits

Industry Legal Group provides advice to members on commercial law matters. If you have any questions relating to the above article, please contact Industry Legal Group on 1300 369 703 or aaaa@industrylegalgroup.com.au