INTEREST RATES AND ENERGY COSTS DRIVE SME SENTIMENT LOWER

Fifth Quadrant reports on the latest wave of the monthly SME Sentiment Tracker

The latest wave of the SME Sentiment Tracker shows both positive and negative indicators in June.

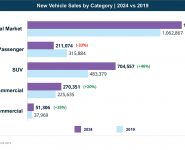

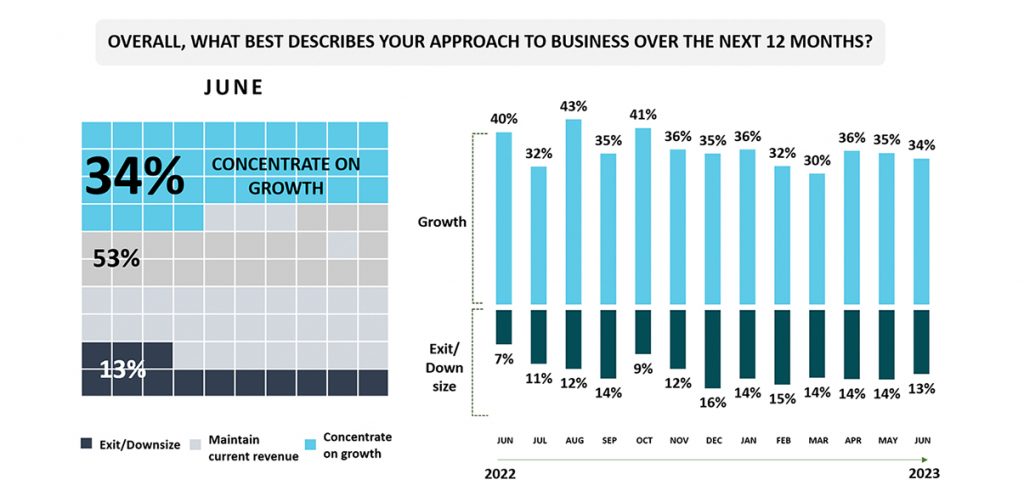

Notably, 37 percent of SME decision-makers reported a good performance in the 2023 financial year, compared to only 17 percent indicating it was a poor year. Additionally, 34 percent of SMEs are planning expansion in the next 12 months.

However, there are major concerns as year on year revenues continue to track down with 34 percent reporting less revenue than 12 months ago.

Profitability has dropped to 46 percent in June from 59 percent in April.

Furthermore, only 21 percent anticipate revenue growth over the next four weeks, a significant decline from 32 percent in March.

Additionally, 87 percent of SMEs are concerned about rising interest rates and 83 percent about energy costs.

Accordingly, 40 percent of SMEs are not well positioned to withstand a recession, and 67 percent expect the Australian economy to weaken in the next three months.

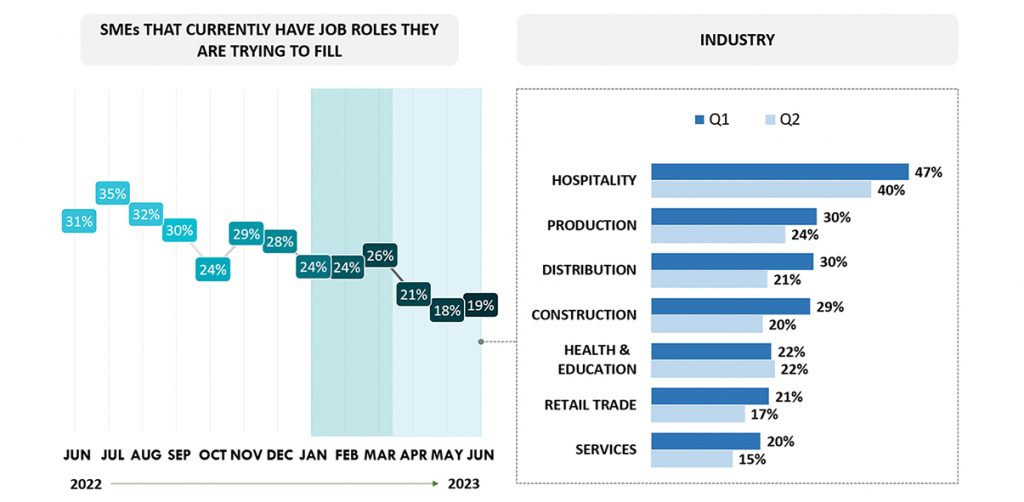

Recruitment activity is stagnant, with only 19 percent actively seeking to fill roles, while 62 percent of these are struggling to find skilled applicants with suitable wage expectations.

Consistent with these challenges, there is an increased demand for additional finance (15 percent) especially for working capital. However, investment in capital equipment and marketing are both expected to decline.

Accordingly, satisfaction with the federal Labor government’s ability to support business needs has declined to 27 percent overall, with particularly low levels of support in Victoria, where it stands at 18 percent.

In summary, Fifth Quadrant says the June data paints a challenging picture.

The research specialist reports the increase in interest rates continues to dampen demand and the cost of doing business continues to rise, making it very difficult for SMEs to remain profitable.

Accordingly, it explains that sentiment remains weak and recruitment activity soft, with these indicators highlighting the tough economic environment SMEs are navigating.

To access the full report, visit www.fifthquadrant.com.au