CONSUMER TRENDS IN OUT OF WARRANTY SERVICING

Consumer automotive servicing is a battleground, with dealerships increasingly competing for service dollars

Many are also shifting their focus beyond the traditional sweet spot of in-warranty servicing, seeking to retain customers as their vehicles age.

On the flipside, independent and chain workshops are improving their services, ensuring they deliver a high-quality experience in the waiting room and under the bonnet.

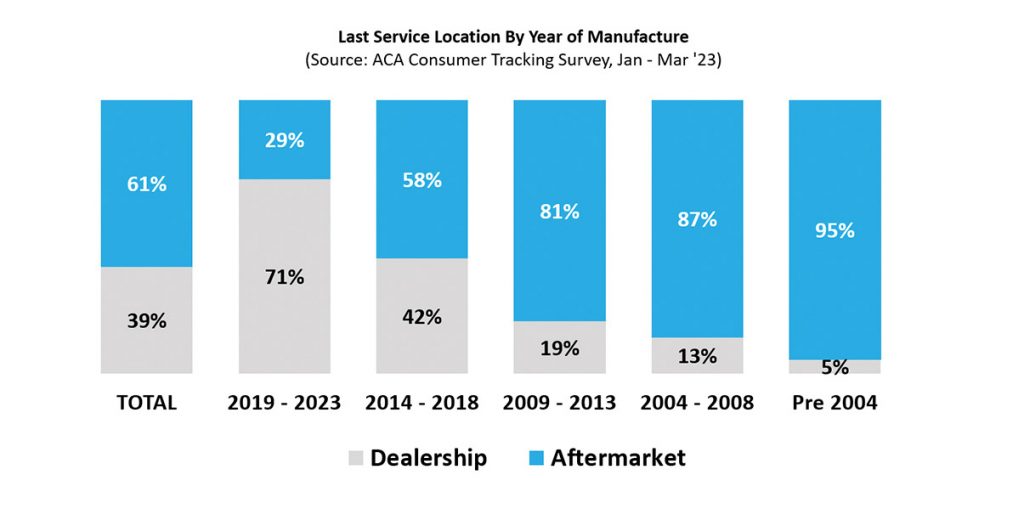

Given that, where are consumers choosing to service as their vehicles age, and how many of them still return to a dealer workshop?

As seen in the graph, the transition is dramatic…around one in four consumers service newer vehicles in the aftermarket, but this jumps to more than half of six to 10-year-old vehicles, and the vast majority for anything older.

We do however need to recognise that consumers don’t all act together, and a number of factors can influence these decisions.

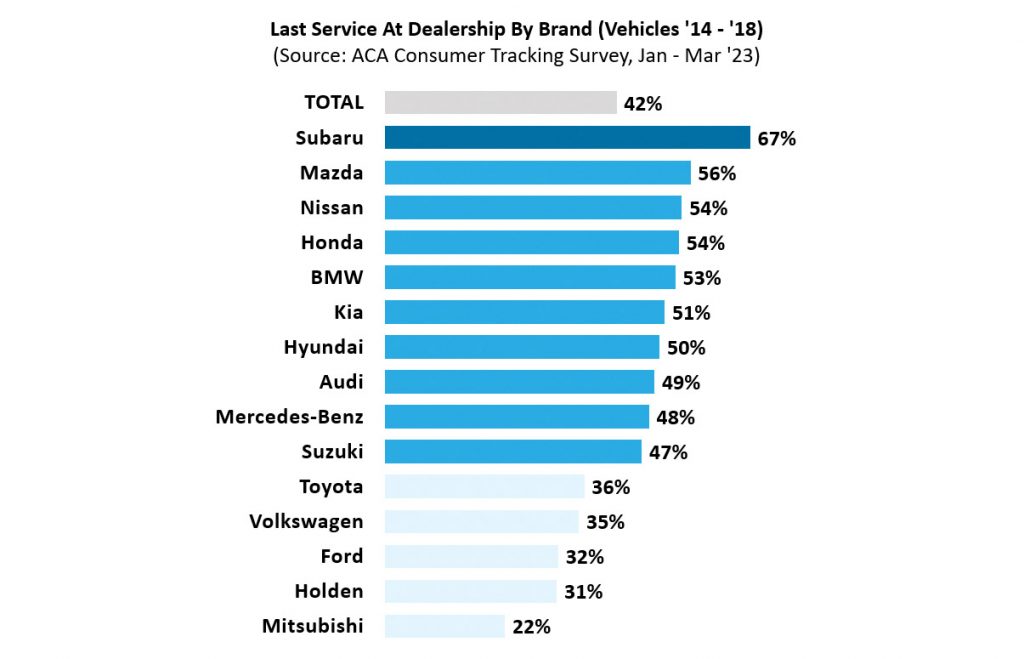

Focusing on vehicles purchased between 2014 and 2018 (ie. those that are in the key six to

10-year age bracket), we see that retention rates are not consistent, with some brands significantly more effective than others at retaining customer servicing business.

Subaru is one brand that stands out from the pack, with two thirds of owners reporting their last service was at a dealership location.

That said, most brands are still performing above average when it comes to servicing these vehicles, typically retaining around half of their customers.

Some brands are however much less effective, capturing a third (or less) of the business on offer:

• Toyota: despite being the market leader (and typically responsible for around one in five vehicles sold), just one in three Toyotas in this age bracket were serviced at the dealership. Whilst this is still a significant number, it leaves a much larger volume for the aftermarket.

• VW: similarly, despite solid sales figures, VW is not doing well when it comes to customer retention. Given a number of aftermarket workshops are targeting premium European brands, this suggests a good growth opportunity (or that they’re already winning this business).

• Ford, Holden and Mitsubishi: it is no surprise that Holden is towards the bottom of the pack given its exit from the market, but Ford and Mitsubishi are also well below average. While we can’t make a direct link, it is very interesting that the bottom three brands on this measure are the ones that used to have local manufacturing.

From an aftermarket perspective, this information can help with planning around marketing activities, as well as internal training and equipment investment.

Based on these trends, workshops will see a significantly greater return on investment by gearing up for Toyota vehicles over Subaru. Whilst European focussed workshops are likely to see a lot more VWs than they are BMWs, Mercedes and Audis.

At an industry level, it also talks to the trust the aftermarket has built with the community, with more than a quarter of new vehicle owners trusting these to their local mechanic, as against returning to the place of purchase.

This column was prepared for AAAA Magazine by ACA Research, the AAAA’s partners in the AAAA Aftermarket Dashboard which is delivered to AAAA members each quarter.

For more information about ACA Research’s services, visit www.acaresearch.com.au or contact Ben Selwyn on bselwyn@acaresearch.com.au