THE EVOLUTION OF VEHICLE TECHNOLOGY

Vehicle technology is a fascinating space, says ACA Research

OEMs are trading off inclusions against cost as they try and deliver a package that appeals to buyers without breaking the bank.

While there is a natural evolution over time, some technologies become commonplace, while others remain more niche, or fall by the wayside.

In this article, we explore a couple of these, looking at their usage across different OEMs.

We talk a lot about vehicles being suitable for local conditions. While part of that is tuning them for our roads, a more basic consideration is Australia’s heat.

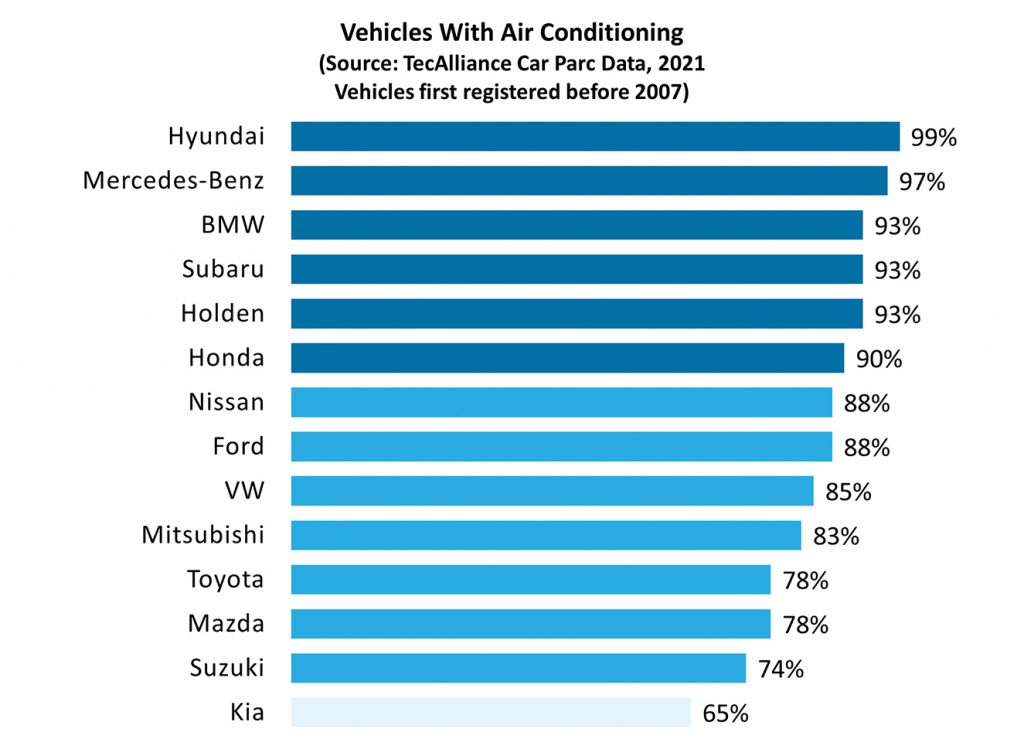

Given that, we tend to take air conditioning for granted. While it’s a fair assumption that newer vehicles include it, this wasn’t always the case. In fact, almost 600,000 of the ~4.2m pre-2007 vehicles on the road didn’t come with air conditioning as standard.

It is no surprise that some OEMs were earlier adopters than others, with premium brands such as Mercedes and BMW leading the way.

There is however an unexpected name at the top of the list – Hyundai was ahead of its time, almost universally fitting vehicles with air conditioning as far back as the early 2000s.

This is even more impressive given just two thirds of vehicles from its sister brand Kia included this feature. We can also see the evolution of Japanese brands, with older vehicles from Toyota, Mazda, and Suzuki lagging behind many local and international competitors.

Fast forward to today, and the technologies might have changed, but we’re still having many of the same conversations.

OEMs are emphasising vehicle safety, with driver assist functions making the transition from niche to mainstream (and even essential for any OEMs seeking a five-star ANCAP rating).

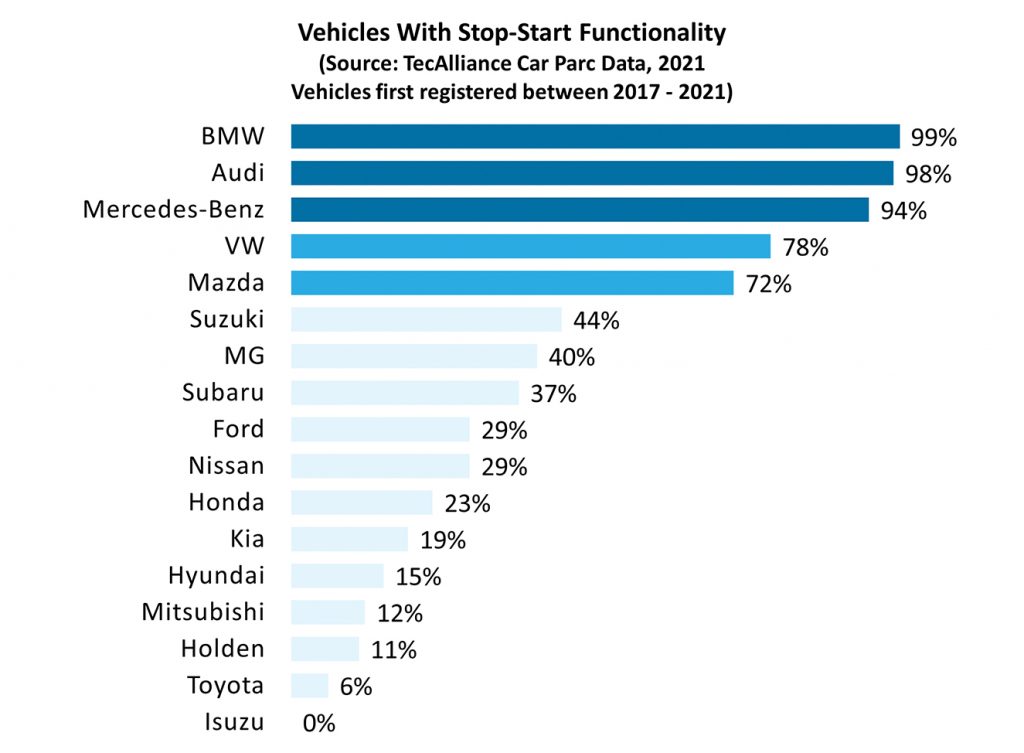

One area that’s seen more mixed adoption however is stop-start engine technology. Despite benefiting fuel efficiency and vehicle emissions, just one in three vehicles from 2017-on offered this, largely driven by premium European brands.

This includes almost all of the vehicles sold by BMW, Audi, and Mercedes, as well as a significant proportion of those from Audi’s sister brand VW. However, Mazda is the only mainstream manufacturer outside of these brands widely using this technology, including it across most of its range (except the BT50 ute).

At the other end of the spectrum, almost no vehicles from market leader Toyota include this function. The exception here is the newly released C-HR compact SUV, suggesting that it could become more common in newer models as they’re released into the market.

From an aftermarket perspective, this can help us understand which technologies we need to be focussing on as we make decisions around investing in training and tools.

As is often the case, this will vary depending on the customer base and car parc you’re servicing.

The key here is to remember that this isn’t static, but changes over time – keep an eye out for the upcoming release of the updated AAAA car parc tool to see what your local car parc looked like in 2022, and how this has evolved over the past five years.

This column was prepared for AAAA Magazine by ACA Research, the AAAA’s partners in the AAAA Aftermarket Dashboard which is delivered to AAAA members each quarter.

For more information about ACA Research, visit www.acaresearch.com.au or contact Ben Selwyn on bselwyn@acaresearch.com.au